nj property tax relief check 2021

We began mailing approved 2020 payments on july 15 2021. Jun 22 2021 112am Updated on Jun 22 2021 By.

Re My Nj Tax Return Not Picking Property Tax Dedu Page 2

COVID-19 is still active.

. We will continue to issue rebates to eligible recipients as 2020 tax returns are processed. Check Your Eligibility Today. It was founded in 2000 and is a participant in the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators.

About the Company Nj Property Tax Relief. Allow time for delivery. About the Company Nj Retirees Property Tax Relief.

News 12 Staff New Jersey property owners could see a 500 property tax rebate under an agreement that state officials announced on Monday. We will begin mailing 2021 applications in early March 2022. Be a New Jersey resident for all or part of 2020.

For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms. Nearly 170000 New Jerseyans received a Senior Freeze reimbursement check worth an average of 1191 for the 2018 tax year according to state data. It has grown about 2 annually in.

For example if an eligible family paid 250 in taxes they would get a 250 rebate check. Just how much property tax relief would people see. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Now the average Homestead Benefit is about 490 and it is calculated based on the 2006 tax year according to the state tax data. 2021 Senior Freeze Applications. Pay online with no fee if paid thru your checking account or a 265 fee if paid with a credit card.

This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. Stay up to date on vaccine information. With questions call New Jerseys Senior Freeze.

Deductions are in the amount of 25000. The deadline to file the application is October 31 2022. The average bill in the state in 2021 was a record 9284 the highest in the nation.

Property taxes are notoriously one of New Jerseys most pressing issues. All property tax relief program information provided here is based on current law and is subject to change. The additions to the existing Homestead Benefit Act focus on low-income disabled and senior homeowners in the state.

For those who qualify the checks are supposed to effectively freeze property-tax bills that now average an all-time high of 9112 in New Jersey. The State of New Jersey also has other relief programs available. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did.

That round of benefits offsetting tax year 2017 property-tax bills was eventually paid out in May 2021. Tax rebate checks arriving soon. Senior Freeze Property Tax Reimbursement Program.

Yes thats Murphys name attached in an election year. If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued. By Nikita Biryukov July 01 2021 347 pm.

NJ Division of Taxation - Local Property Tax Relief Programs. In June New Jersey lawmakers revealed a new budget that will expand property tax relief for residents. Forms are sent out by the State in late Februaryearly March.

15 2021 204 am. CuraDebt is a company that provides debt relief from Hollywood Florida. Phil Murphys name but not his signature will appear on tax rebate checks the state will send to certain New Jerseyans with at least one dependent child starting this Friday.

Property Tax Relief Programs Senior Citizen and Veteran deductions are available to qualifying applicants. Last year Murphy and lawmakers held back funding for Homestead benefits after revenue losses experienced during the first few months of the coronavirus pandemic swamped the states meager budget reserves. If the 2021 property taxes for the entire property to- taled 4000 and the 2020 property taxes totaled 3800 and you indicated at line 12b that you occupied 25 of the property one unit you must enter 1000 4000 25 on line 13 and 950 3800 25 on line 14.

This article was updated with comment from Gov. News 12 staff new jersey property owners could see a 500 property tax rebate under an agreement that state officials announced on monday. To use this service you will need the Social Security number that was listed first on your Senior Freeze application Form PTR-1 or.

We began mailing checks July 2 and anticipate it will take about six weeks for all of the initial checks to be processed. NEW JERSEY As part of a 319 million package that Gov. Review the updates to learn whether you may benefit from New Jersey property tax reform measures.

You will get the difference between your base year first year of eligibility property tax amount and the current year property tax amount as long as the current year is higher than. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Phil Murphy and lawmakers agreed to in September about 800000 Garden State residents could receive a 500 rebate check within a few weeks.

Phil Murphy at 422 pm. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. To qualify you must.

Click on the following links to view what is available. Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. Murphys name will appear on tax rebate checks.

Submit a 2020 NJ-1040. Residents who paid less than 500 in income tax will receive an amount equal to what they paid. If you think you may qualify please call the tax collectors office.

It was founded in 2000 and is a participant in the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. Call NJPIES Call Center. 06 2021 830 am.

Nj property tax relief check 2021. However New Jerseys most expensive property-tax relief program according to budget documents allows homeowners regardless of their annual income to deduct up to 15000 in local property taxes annually.

My Nj Tax Return Not Picking Property Tax Deductio

New Jersey Sales Tax Small Business Guide Truic

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Where S My New York Ny State Tax Refund Ny Tax Bracket

Township Of Nutley New Jersey Property Tax Calculator

Freehold Township Sample Tax Bill And Explanation

Where S My Refund New Jersey H R Block

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Nj Property Tax Relief Program Updates Access Wealth

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Re My Nj Tax Return Not Picking Property Tax Dedu Page 2

Here S When You Can Begin Filing Federal Tax Returns And Why The Irs Says It May Be Frustrating Nj Com

Freehold Township Sample Tax Bill And Explanation

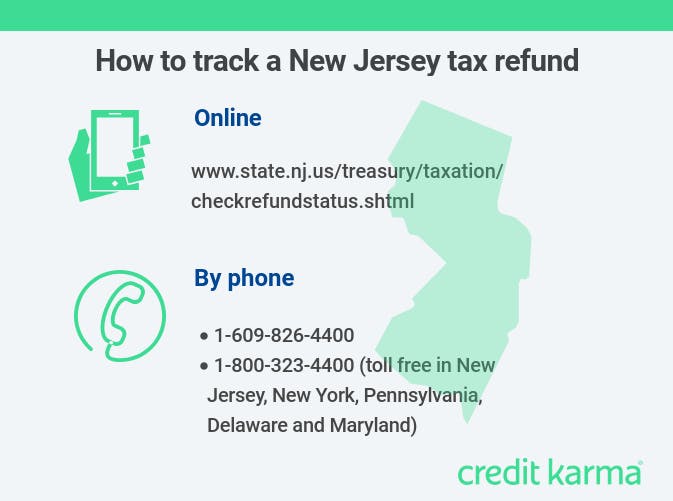

How To Track A Nj Tax Refund Credit Karma Tax